The good governor repeated it over and over again.

“Under my plan, all West Virginians who own a vehicle would receive a full dollar for dollar refund.”

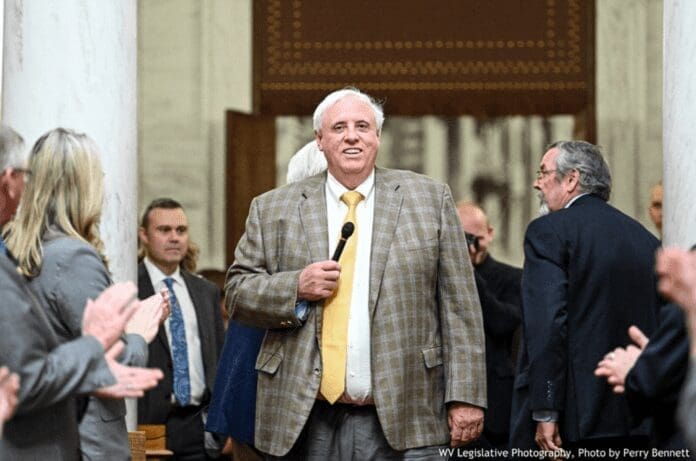

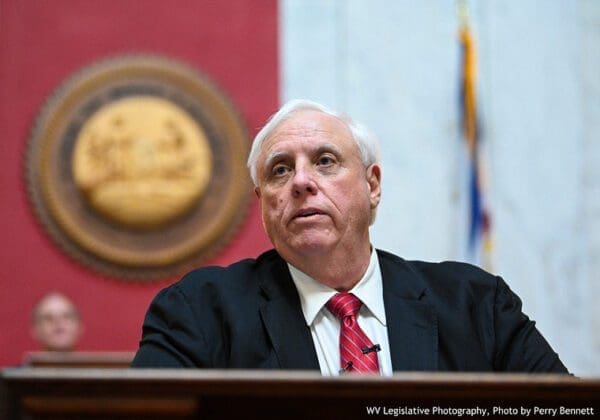

Gov. Jim Justice repeated the same pledge throughout the Mountain State while campaigning against his own Republican leadership in the House and Senate and their proposed amendments that appeared on the ballot on November 8. He formerly introduced the plan in a press release distributed statewide on Oct. 11.

“Today I am proposing legislation to get rid of the car tax immediately without amending our Constitution,” the release stated. “This means you can vote no on Amendment 2 and still get rid of the car tax. As soon as the House and Senate are ready to take this up, the bill is in their hands. It’s ready when they’re ready.

“The proponents of Amendment 2 claim that we must change our Constitution forever to eliminate the car tax. Not only is that untrue, it’s just plain deceptive. It can be done, and we have the way right here, without making a major amendment to our Constitution.”

Gov. Justice, a Republican who recorded the fifth-highest approval rating of any American governor back in July, also included the following:

“The Senate is using the car tax as bait. Don’t take it. They’re trying to pull a fast one on you. You’re smarter than that. By voting for Amendment 2 you are giving hundreds of millions of dollars and massive control to Charleston and giving big companies big tax breaks.”

Well, Amendment 2 was rejected by 65 percent of West Virginia voters, so will Gov. Justice now push lawmakers to approve his rebate idea?

Del. Shawn Fluharty, one of 12 Democrats who will return to the House of Delegates in January, believes the governor will run into roadblocks if he seeks support from his fellow Republicans.

“I am sure Governor Justice will try to get the rebate through the Legislature like he promised during his personal campaign against the amendments, but it will be interesting to see if the leaders of the Republican Party will want to hear anything about it since the two sides butted heads,” he explained. “I know I’d support the rebate program because I supported placing the option for the elimination of the personal property tax on some items. That was part of an amendment that came from state Democrats.

“Do I think it will fly? I doubt it. Would I like to see it? I would because the majority party is sitting on millions of dollars in tax revenue and the people deserve something in return for the cuts and changes that have gone into place,” the delegate insisted. “I do know the upcoming regular session is going to be interesting for sure, and it’s my hope that we keep our residents in mind when making the big decisions for the state of West Virginia.”

From “Super” to “Mega”

The midterm election results in West Virginia favored Republicans across the state’s 55 counties, and in the Northern Panhandle Fluharty remains the lone Democrat representative after winning in District 5 by just 464 votes over GOP challenger Brooke McArdle.

After all votes were tallied, the Mountain State’s Republican Party now holds an 88-12 advantage in the House, and a 30-4 majority in the Senate.

Del. Erikka Storch (R-3rd) also was victorious on Election Day, winning District 4 by 2,999 votes over Democrat Teresa Toriseva, and she insists she would support make-sense legislation that returns tax dollars to taxpayers.

“The Republican majority could create a bill to suggest a tax rebate program for personal properties like our vehicles similar to what the Governor promoted while he was campaigning against Amendment 2,” Storch said. “The Governor could propose to the Legislature what his rebate idea would look like and then the Speaker, the minority leader, and the Senate President and the Senate minority leader could cooperate with introducing legislation that could make it happen.

“But it would mean that we would write our check to the respective county but then receive a rebate from the state, so that whole situation would have to be figured out,” she explained. “The way the governor explained it, we would still pay the tax to get our registration renewed but then would have to send a copy of our tax receipt. That sounds like it’s going to create a lot more work for someone in the county and for people with the state, but I believe we definitely need to give some of the surplus revenue back to the people.”

Greg Thomas, a GOP operative out of Charleston, said this week on River Talk 100.1 FM that he does not expect legislative leadership to entertain Justice’s rebate plan, but he does foresee interest in the governor’s proposed 10 percent permanent reduction in the state’s personal income tax.

“I don’t believe there’s a chance the car tax thing will go anywhere, but Republicans are always for tax cuts, right? It’s a fundamental of the party, so something with the income tax probably will be on the table when the session starts in January,” he explained. “But it’s something that should be introduced at the very beginning of the session so the chambers have plenty of time to toss it back and forth until they come up with something they can agree on.

“That’s why I expect there to be a lot of conversations about the billion-dollar surplus and what to do with it,” Thomas added. “And I’m sure everyone in the Legislature will have their own ideas so it’ll be up to leadership to bring the members together to get something done for the people.”